MORE THAN HALF OF ALL TV VIEWERS PREFER AD-SUPPORTED STREAMING SAYS NEW STUDY FROM FUTURE TODAY AND VARIETY

New Research Reveals Emerging Consumer Streaming Habits and TV Viewing Preferences

Menlo Park, CA – September 8, 2021

Data Highlights:

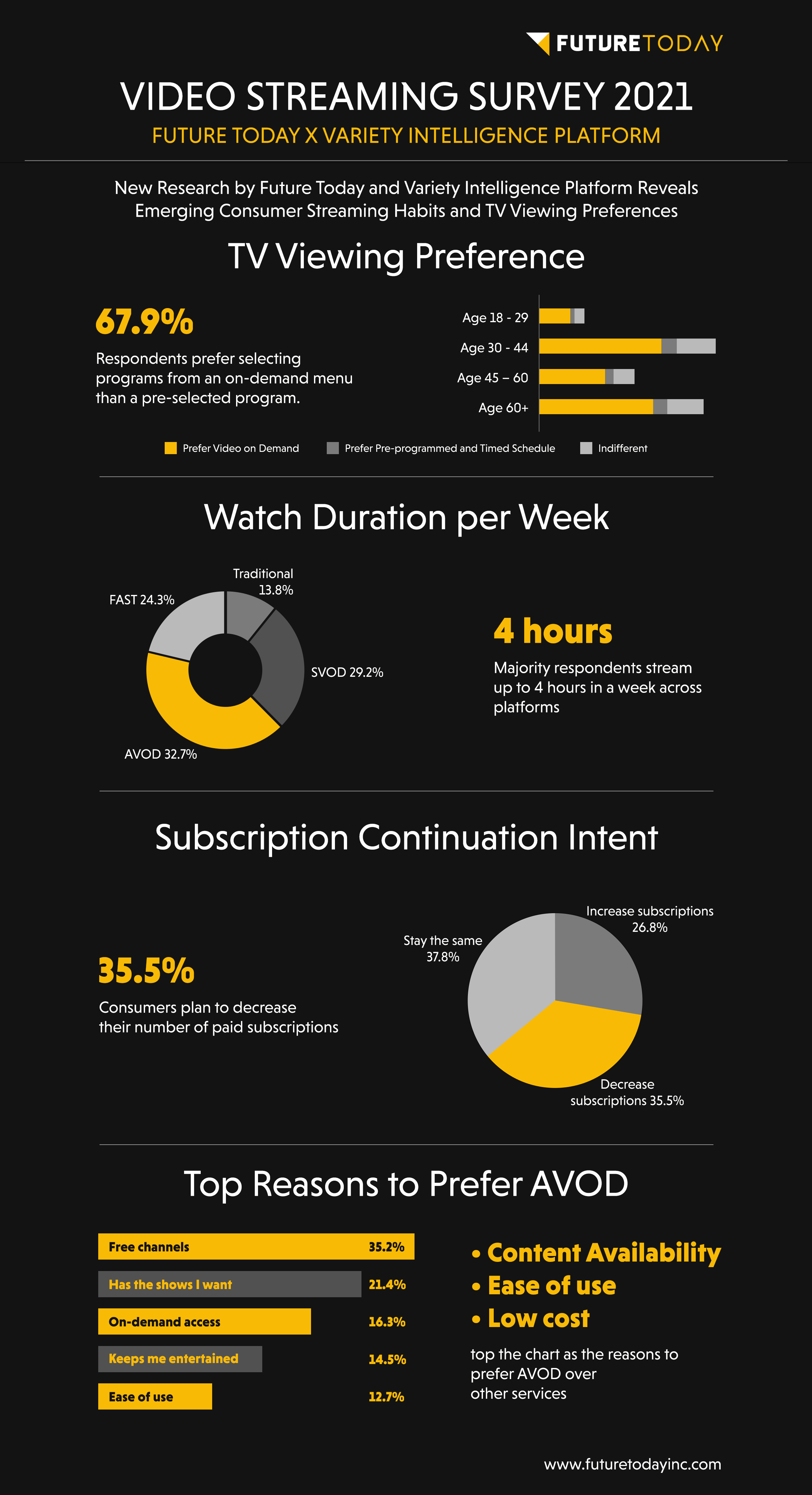

⦁ The majority of consumers (67.89%) prefer choosing the individual programs they’d like to watch on an on-demand basis, compared to just 12.5% who prefer pre-programmed, linear channels

⦁ 50.6% of US consumers prefer using ad-supported video services to reduce costs

⦁ Streaming ads are twice as likely to be relevant to a viewers’ interests than ads seen on cable or broadcast TV

⦁ 35.5% of consumers plan to decrease their number of paid subscriptions

⦁ Of those who have used a free trial in the last 12 months, 41.2% subscribed after the trial ended

Menlo Park, CA – September 8, 2021 – More than half (50.6%) of US consumers prefer using ad-supported video (AVOD) services to reduce or eliminate subscription fees, according to new research from multichannel streaming leader, Future Today, and Variety’s Variety Intelligence Platform (VIP+). Similarly, viewers find the ads shown while streaming are considerably more relevant to their interests compared to those shown on traditional cable or broadcast television.

These findings and insights come from the recent “Future Today x Variety Intelligence Platform Streaming Study,” which took an in-depth look at the latest TV viewing behavior and streaming preferences, polling U.S. consumers to identify the emerging trends shaping OTT, advertising, and the broader TV industry.

“Consumer viewing preferences continue to evolve. Streaming has become the de facto source for watching TV shows and movies, but not all services, platforms and models will thrive in this shifting media landscape,” said Vikrant Mathur, CEO and Co-Founder of Future Today. “Despite some pundits’ expectations, we’re seeing AVOD adoption flourish, and expect this trend will continue to grow for years to come. Our research solidifies that with the right viewing experience, the ad-supported streaming model is ideal for content owners, brands and, most importantly, audiences.”

“The world of free streaming is in a state of metamorphosis. FAST in particular is very distinct from its first era, but as the findings from the Streaming Study show, the change is not complete,” added Gavin Bridge, Senior Media Analyst, Variety Intelligence Platform. “Future trends to note will be the involvement of more big media brands as FAST becomes a new distribution strategy for getting content in front of viewers.”

Key themes and findings from the research include:

OTT vs. Traditional TV Viewing

With the exception of viewers 60 years and older, consumers today are spending more time streaming than watching traditional TV. On average, consumers spend 10.6 hours per week viewing streaming services (SVOD, AVOD, and FAST) compared to just 8.3 hours viewing cable or broadcast TV. Those figures increase dramatically for younger demographics:

⦁ Age 18-29 spends nearly 4x as much time watching OTT

⦁ Age 30-45 spends more than 2x as much time watching OTT

⦁ Age 46-60 spends just 16% more time watching OTT

⦁ Age 60+, on the other hand, spends nearly 40% more time watching cable or broadcast TV

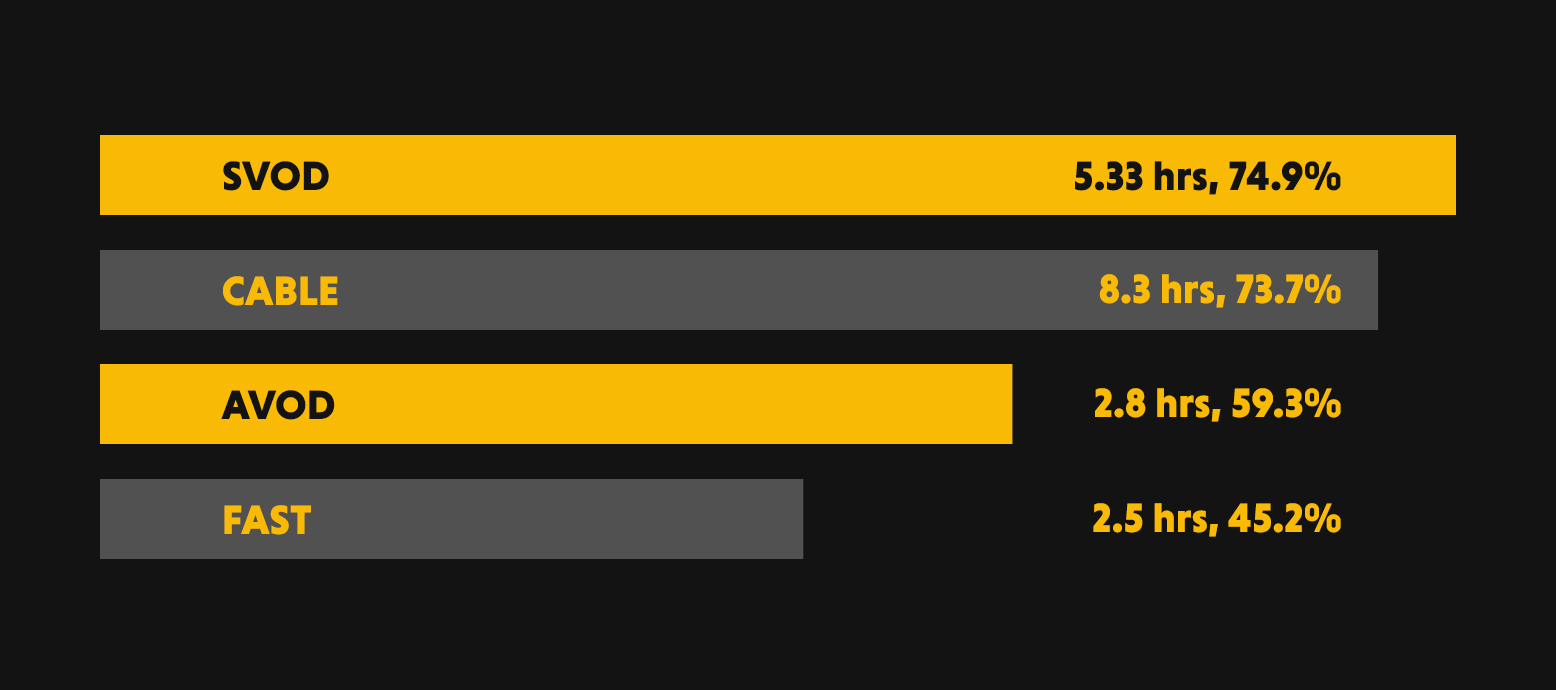

The survey also found that, on average:

⦁ 74.9% of TV viewers watch SVOD services, averaging 5.33 hours per week

⦁ 59.3% watch AVOD services, averaging 2.78 hours per week

⦁ 45.2% watch FAST channels, averaging 2.45 hours per week

⦁ 73.7% watch traditional cable or broadcast TV, averaging 8.3 hours per week

OTT Advertising

Ad-supported streaming services are not only the preferred choice for more than half of consumers, but they also provide a better ad experience compared to traditional television. While roughly half of participants felt streaming ads and traditional TV ads were “about the same,” the study found that, on average, ads served while streaming are twice as likely to be more relevant to a viewers’ interests than those seen on cable or broadcast TV. This increases further for viewers aged 18-29, who found streaming ads more than four times as likely to relate to their interests.

But for an ad to be engaging, users still demand a premium viewing experience. The top three frustrations when using AVOD services are:

⦁ Showing the same ad multiple times during an ad break (40.2%)

⦁ The amount of advertising per hour of programming (39.3%)

⦁ The interruption caused by advertising (33.3%)

Linear vs. On-Demand

The majority of consumers (67.89%) prefer choosing the individual programs they’d like to watch on an on-demand basis, compared to just 12.5% who prefer pre-programmed, linear channels. This holds true across age groups, with viewers 60+ reporting 65.5% and 17% respectively

COVID’s Effect on Video Consumption

⦁ 35.6% of consumers stream more now than they did prior to the COVID, and only 3.9% stream less

⦁ Streaming increased the most among consumers aged 18-29, with 41.3% streaming more now than before the coronavirus pandemic began

Do Free Trials Really Work?

⦁ Nearly 3 in 10 viewers (28%) have used one or more free trials for a streaming service in the last 12-months, with only 4.8% using three or more. Participants aged 18-29 are the most likely (38%) to use free trials

⦁ The top three reasons for using a free trial are: to sample the service before purchasing (31%), to binge a single TV series or movie before the trial ended (24%), it came free as a promotion with another purchase made (14.7%)

⦁ Of those who have used a free trial, 41.2% subscribed after the trial ended

Consumers are Tired of Paying for Too Many Subscriptions

⦁ 13.5% of consumers have already stopped using a streaming service within the past year. Viewers aged 18–29 had the highest cancellation rate at 19.6%

⦁ 35.5% plan to decrease their number of subscriptions in the next 6 – 12 months, while only 26.8% expect to increase their subscriptions

Consumers Prioritize Personalization & Recommendations.

⦁ Nearly half of consumers (49.5%) find it important that a streaming service tailor the content and recommendations based on past viewing history and interests, while 28.34% prefer not to have services personalized

⦁ Preferences vary greatly among age groups: younger viewers (18-29) find recommendations the most important (62% prefer), the oldest viewers (60+) care the least about recommendations (37.6% prefer)

Content Is Still King

While the reasons for watching different streaming services vary, the commonality is clear: having popular content is the key to growing audiences. The survey found the top three reasons for watching different types of streaming services are:

⦁ AVOD: 1) it has the shows I want (21.5%); 2) free channels (19.1%); and 3) on-demand access (16.4%)

⦁ SVOD: 1) it has the shows I want (35%); 2) binge watching (34%); and 3) on-demand access (31%)

⦁ FAST: 1) Free channels (18.4%); 2) it has the shows I want (15%); and 3) to pass time (13.2%)

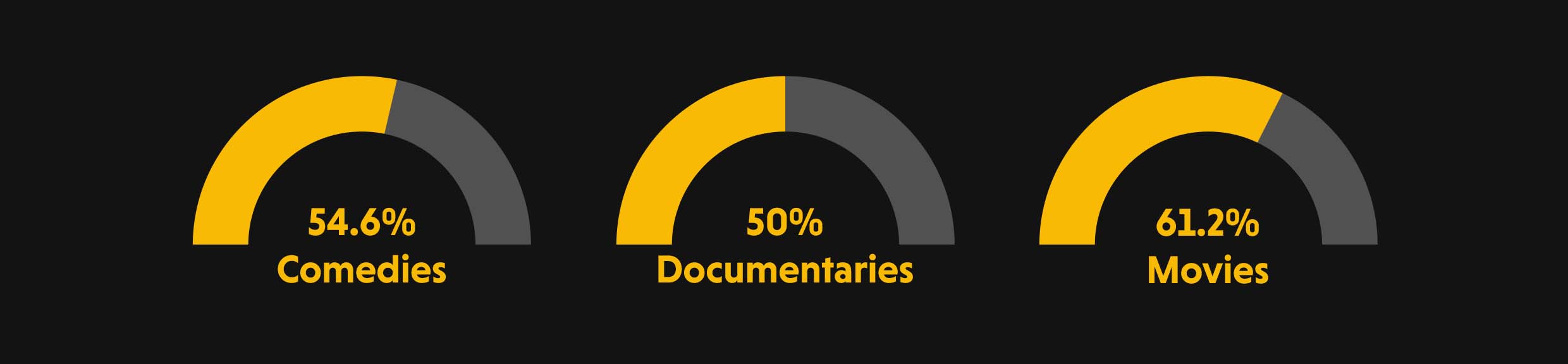

What People Watch Most

When choosing what to watch, the top 3 most popular content categories are: —

Similarly, when choosing a service to watch, consumers are most likely to tune into:

⦁ Netflix (62.6%)

⦁ Amazon Prime (54.2%)

⦁ YouTube (44%)

⦁ Hulu (34.3%)

⦁ Disney Plus (25.3%)

⦁ HBO Max (24.9%)

Launching New FAST Channels

When launching a new FAST channel, audiences are most likely to watch channels named after:

⦁ 38.4% A topic the viewer is interested in (e.g., Poker, Outdoors, Food, Yoga)

⦁ 34.8% A TV show they like (e.g., Unsolved Mysteries, The Challenge, Baywatch, CSI, Keeping Up with the Kardashians)

⦁ 33% An existing TV Channel (e.g., NBC, MTV, FOX, etc.)

Alternatively, audiences are least interested in FAST channels named after:

⦁ 50.7% a sports league

⦁ 37.9% the video service they are watching (e.g., Xumo TV Westerns, Pluto TV Drama Life, Peacock Reality)

⦁ 37.3% an original title presented by a TV brand (e.g., Rush by AMC, Skills + Thrills presented by History)

The “Future Today x Variety Intelligence Platform Streaming Study” studied numerous topics and compares FAST channels to AVOD to SVOD to traditional TV viewing in a statistically relevant sample of over 1,000 consumers across the United States. The survey was conducted between June 15 and June 30, 2021, as a means of investigating consumer streaming preferences and viewer behavior.

About Future Today

Future Today is a leader in the ad-supported streaming media universe with its flagship channels – FilmRise, Fawesome and HappyKids – ranking in the top free channels across nearly every OTT consumer platform. The company’s proprietary, cloud-based technology platform manages OTT services for more than 350 content owners, producers, distributors and major media companies helping them launch and monetize complex Connected TV channels across devices in a matter of days. Future Today’s comprehensive portfolio of technology and services includes video management, content management and publishing, app development and maintenance, cross-channel promotion, advertising, monetization and more. Learn more about Future Today here.

For more information, contact:

Chris Huppertz

Bob Gold & Associates

310-320-2010

futuretoday@bobgoldpr.com

Have more questions?

Please be in touch – we look forward to hearing from you.